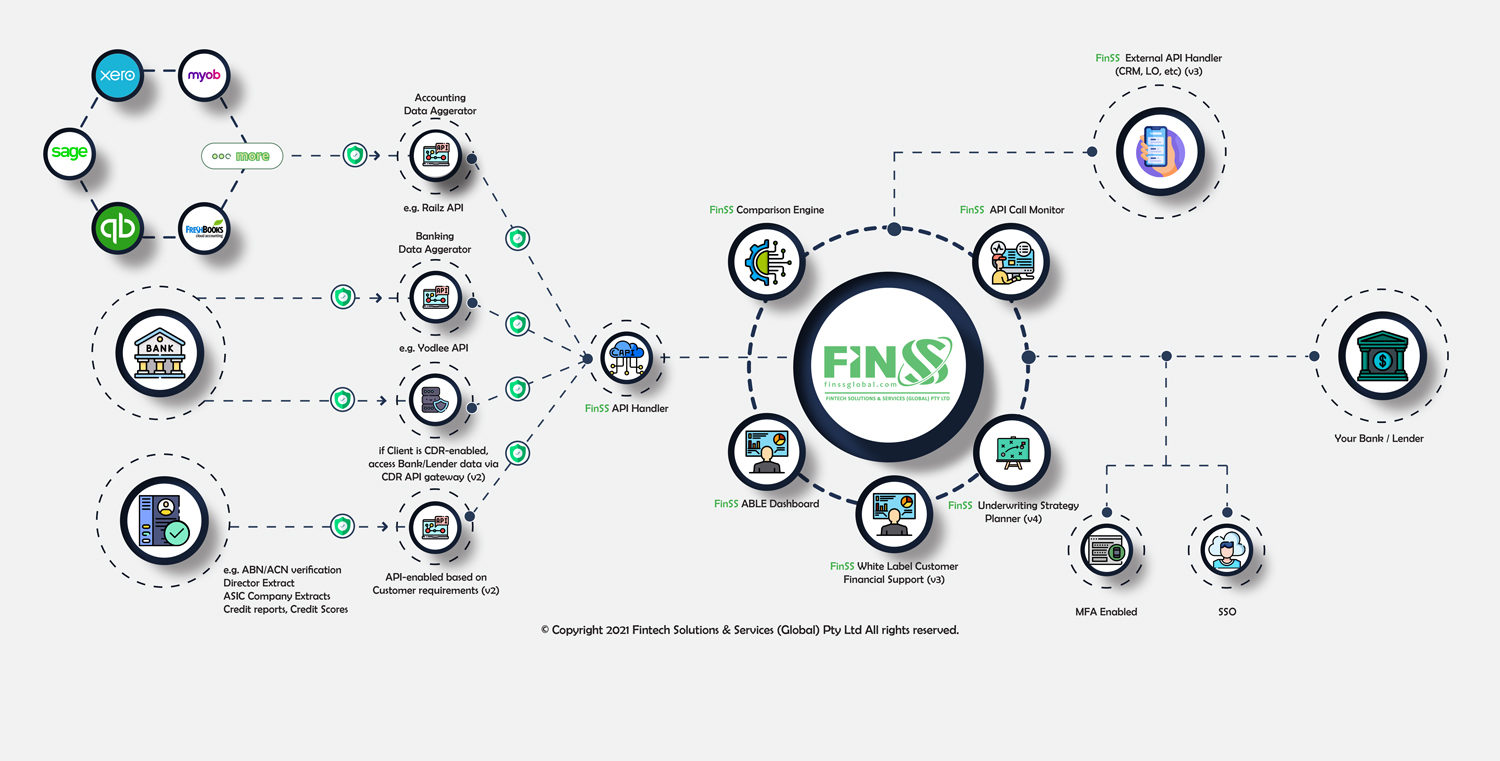

enABLED © has been developed to help Small to Medium Banks, Credit Unions or Lenders who are interested in increasing their Commercial Lending portfolio and want to semi-automate and speed up the validation, verification and pre-approval rates for Small Business Loans. It is a Cloud-based solution to digitally aggregate, compare, visualise data and metrics from configurable Financial-centric data sources.

enABLED © (All-in-One Business Lending Enterprise Dashboard)

Aggregate | Validate | Visualise | Assess

All-in-One Business Lending Enabler (ABLE) Dashboard

Aggregate | Validate | Visualise | Assess

The ABLE Dashboard has been developed to help Small to Medium Banks, Credit Unions or Lenders who are interested in increasing their Commercial Lending portfolio and want to semi-automate and speed up the validation, verification and pre-approval rates for Small Business Loans. It is a Cloud-based solution to digitally aggregate, compare, visualise data and metrics from configurable Financial-centric data sources.

enABLED ©

FinSS Global has observed that of the smaller Banks/Lenders/Fintechs who provide Small to Medium Business (SMB) Business Lending, few have digitised and automated their Lending processes; or aggregate data and analytics to validate and simplify their lending decisions. Lending decisions still seem to be reliant on manual and labour-intensive processes taking days, if not weeks, to turn around any decision, positive or negative, to a Borrower wanting (pre-) approval within hours, if not a days. So, what if this could be automated, streamlined and visualised?

Well, enABLED © does just this. It has been designed, architected and developed to be an all-in-one Business Lending enabler. It is a digital aggregation platform utilising leading edge API and integration technology to help Small Business Lenders automate, compare, validate and visualise data and analytics from Banking, Accounting, Credit and any other Financial-centric data sources.

enABLED © Product Features

On-premise/Private Cloud Deployable

Software Version upgrades or major new Product releases will be based on upgrade or new product fees

Reduce implementation and configuration time and cost by deploying to the Cloud

Software fess include maintenance and support for bug fixes and minor enhancements

A complete Digital experience to simplify Business Lending, Reduce Decision Times & Increase Revenue

Key Technical Features

Industry Expertise & Support

• Worked with Business Lenders to define most of the features & key metrics.

• Support is local through a local number, email and contact.

• Price includes Maintenance and Support.

Documentation & Training

• High-level, product-specific internal User Help.

• Context-sensitive help on all critical fields.

• User and Admin training is available upon request.

Modern User Experience

• Provides fast, reliable, simple & latest UX.

• Screen skins can be configured to match end-user look and feel.

• Usability tested by several SME Lenders validating the UX.

Configurable

• All action items are configurable and initiated automatically, upon request

• Data source aggregation is totally extensible and configurable.

• Analytics and metrics displayed are configurable, based on end-user requirements.

• Visualisations are tailorable dependant on end-user requirements.

Built to Support Automation

• Data Aggregation is automated once SMB Lender is identified.

• Validation and anti-fraud checks automated post aggregation.

• Timeframes (dates) for aggregation process are configurable.

Complete Data Security – Internal & External

• User access is controlled by secure role-based uid/pwd.

• System integrates with Cloud or Managed Service Security Protocols.

• Multifactor Authentication can be configured based on end-user requirements.

Built to Scale & Perform

• Built using standard Open Source technology.

• Frontend & Backend - Using modern development languages

• API/Microservices.

Open API/Microservices enabled

• All communication with external systems is API-driven.

• Microservice/API-enabled to integrate with other Financial Services data sources.

Cloud and/or Managed Service Deployable

• Solution can function as a Service.

• Functions as a typical web application.

• All input automated based on end-user input.

Tailored Online & Telephone Support

• 5x8 Support is included in the license fee.

• Telephone and email support, based on defined SLAs.

• Extended Support can be provided upon request.